202328 Historical demand and supply. A comprehensive time series of gold demand broken down by sector and country and gold supply broken down by mine

202381 Discover gold supply and demand reports to understand gold market trends. Read more about gold demand and supply commentary from the World Gold Council here.

20231031 Highlights The LBMA (PM) gold price averaged US$1,928.5/oz during Q3. Although 2% below the record high seen in Q2, this was 12% higher y/y. Several

20231030 Sectors of Demand Geographical Diversity. Today's demand for gold comes from the most diverse set of consumers and investors than ever before. Learn more about gold demand and explore

20211028 Average quarterly and annual gold prices are in US$/oz, unless otherwise specified. Comprehensive data on gold demand by country broken down by sector.

2022128 Important disclaimers and disclosures [+] Total supply fell 1% y-o-y in 2021; a sharp drop in recycling more than offset higher mine production. Find out more

202381 Comprehensive data on gold demand by country broken down by sector. Explore overall gold demand and supply statistics from all regions.

202321 Worldwide gold demand amounted to 4,740.8 metric tons in 2022, an increase from 4,012.8 metric tons in the previous year. Also, 2020 was the first time demand for gold was lower than 4,000...

20231030 Recycling is the source of gold supply that is most immediately responsive to the gold price and economic shocks. The majority of recycled gold at least 90% comes from jewellery, with gold extracted from technology providing the remainder. Of course, for gold to be of a guaranteed quality, it needs to be processed and refined.

20231023 Demand and supply. Data on various sectors of gold demand and supply, as well as productions costs and futures market positioning Physically-backed gold exchange-traded funds (gold ETFs) are an important source of gold demand, with institutional and individual investors using them as part of well-diversified investment

2022128 The US dollar gold price declined by around 4% during 2021.2 Nevertheless, the average price for the year of US$1,799/oz was around 2% higher than 2020, as the price was relatively steady, holding within a broad range for much of the year. Total gold supply eased marginally in 2021: down 1% at 4,666t, its lowest level since 2017.

2022624 Global gold mined supply is forecast to increase approximately 4.6% year over year in 2022. Despite the macroeconomic and inflationary pressures, the global mined supply of gold and physical demand appear to be robust through year-end and out to 2026. Review our new monthly gold market analysis and price forecast. Download report.

20231031 Gold demand (excluding OTC) in Q3 was 8% ahead of its five-year average, but 6% weaker y/y at 1,147t. Inclusive of OTC and stock flows, total demand was up 6% y/y at 1,267t. 1. Net central bank buying of 337t was the third strongest quarter in our data series, although failed to match the exceptional 459t from Q3’22.

Statistics and information on the worldwide supply of, demand for, and flow of the mineral commodity gold. Gold has been treasured since ancient times for its beauty and permanence. Most of the gold that is fabricated today goes into the manufacture of jewelry. However, because of its superior electrical conductivity and resistance to corrosion

Demand for gold often overlaps with gold supply, which is in turn a combination of gold mining and recycling. There is currently and estimated 197,576 tonnes of gold above ground as a result of gold mining operations, and an estimated 54,000 tonnes of gold left to be mined. This means supplies are finite, and only 20% of the Earth’s supply

20221217 There are five key factors. Demand for Gold. Gold Supply. Value of the US Dollar. Inflation. Uncertainty. Familiarizing yourself with these five factors that affect gold prices can help you assess the gold market, gold prices, and help you make a decision on when to buy gold. 1. Demand for Gold.

20211019 The drivers of gold demand in India are many and varied. Cultural affinity, long-held tradition and festive gifting clearly play a significant role. they tend to drive parts of the gold supply chain underground. Between Q3 2013 and Q4 2014, some 335t of gold was smuggled into the country, around a quarter of total demand. And, in the second

20231030 The total supply of gold worldwide amounted to some 4,490 tons in 2018, and is projected to amount to 4,533 tons in 2023. South Africa's gold supply 2013-2023; South Africa's gold demand 2013

20231030 The total supply of gold worldwide amounted to some 4,490 tons in 2018, and is projected to amount to 4,533 tons in 2023. South Africa's gold supply 2013-2023; South Africa's gold demand 2013

2021128 The technology sector, impacted by disruption from COVID-19, saw gold usage decline 7% in 2020 to 301.9t. But the year ended on a relatively positive note, with Q4 seeing marginal y-o-y growth

Contrary, the average price of gold fell from $1,411 in 2013 to $1,266 in 2014, although central banks increased their net purchases from 409.3 tons to 477.2 tons. Chart 3: Central banks’ demand (in tons; blue line, right axis) and average annual gold prices (yellow line, left axis) from 1997 to 2014. Moreover, central banks possess only

2022111 Gold Demand Trends Q1 2022. Gold market sees solid start to 2022. Q1 gold demand was 34% above Q1 2021, driven by strong ETF inflows. In a quarter that saw the US dollar gold price rise by 8%, gold demand (excluding OTC) increased 34% y-o-y to 1,234t the highest since Q4 2018 and 19% above the five-year average of 1,039t. 28

2020326 The gold stock of the country at the end 1997 was close to 10,000 tonnes valued at current prices on the world market at $ 120 billion. This is nearly four times the country's exports and of

2020109 A quick glance at the demand for gold in India, the supply of gold in India and amount of gold imported to India paints a stark picture. Source: GFMS Gold Survey 2014 1283 987 210 176 168 582.9 102.8 335.9400 89.8 36.2 0 200 600 800 1000 1200 1400 China India United States Turkey Thailand Gold Demand Domestic supply of

2 Gold Market Structure and Flows. Understand global gold market structure and flows in this set of infographics, detailing the sources of gold supply and of demand, with an indication of trading volumes, and the scale and composition of

2016111 Over the past 5 years; Indians have recycled an average of 105 tons of gold per annum. In October 2008, demand for gold increased; celebrations like Diwali and Akshaya Tritiya was the main factor

2021122 Conclusion. Studying the supply and demand of gold is an essential skill for most gold traders. In addition, investors should pay attention to the global investment market, as investors and institutions stockpile gold due to its safe-haven properties. Demand for gold also tends to rise and fall depending on the monetary policies implemented by

202381 Outflows result in H1 disinvestment. Global gold ETFs experienced net outflows of US$3.7bn (56t) in June, calling a halt to their three-month inflow streak. June’s outflow caused global gold ETF demand during H1 2023 to turn negative, leaving collective holdings of global gold ETFs at US$211bn (3,422t). 6 July, 2023.

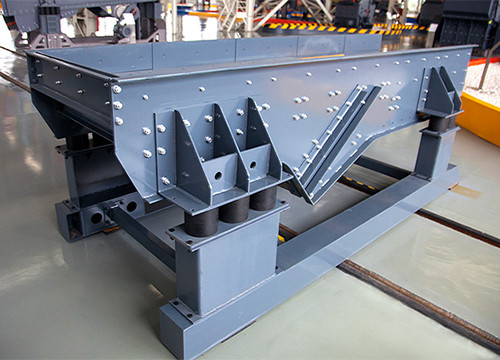

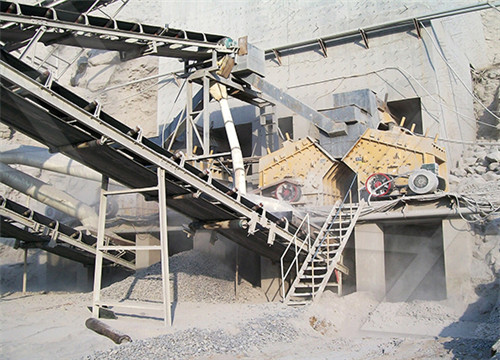

قواعد انتاج قوية، وفيرة الخبرة في التصنيع وفريق البحوث المهنية تساعد التنمية في عمق آلات التعدين. كلا النوعين المنتجات والنماذج قادرة على تلبية جميع مطالب في هذه الصناعة، وضمان الجودة وتسليم المعدات.

إذا كنت مهتمًا بشركتنا أو منتجاتنا ، فسيقوم موظفونا بتزويدك بإخلاص بمعلومات المنتج ومعرفة التطبيق والخدمة الجيدة.

بودونغ ، شنغهاي ، الصين